🚜 RV Depreciation Calculator

Calculate your RV's current value and projected depreciation over time

Year 1

Year 1

Year 1

Year 1

Year 1

Year 1

Year 1

Year 1

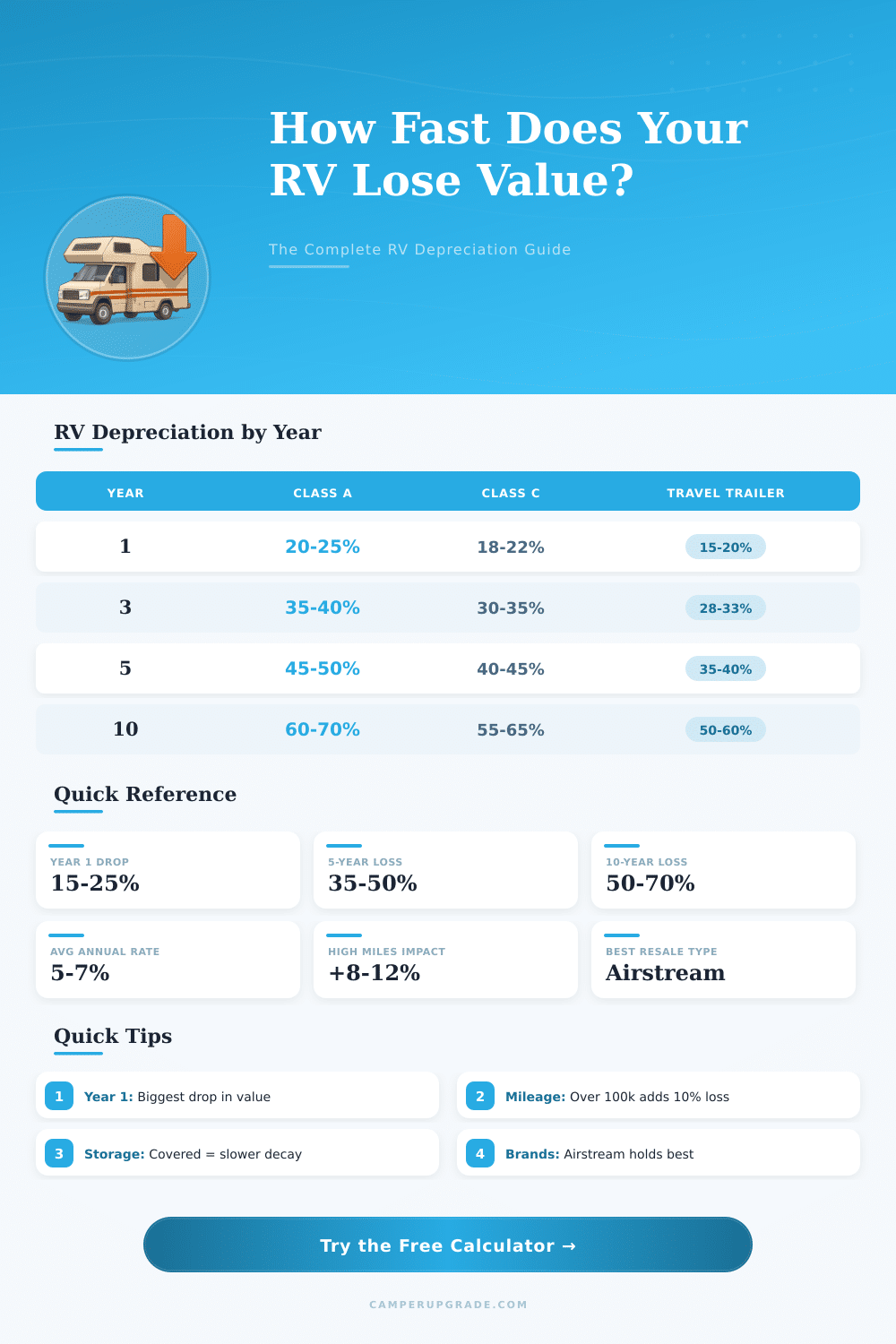

| Year | Class A | Class B | Class C | Travel Trailer | Fifth Wheel |

|---|---|---|---|---|---|

| 1 | 77% | 86% | 80% | 82% | 80% |

| 2 | 70% | 80% | 74% | 76% | 73% |

| 3 | 63% | 74% | 68% | 70% | 67% |

| 5 | 52% | 64% | 57% | 61% | 56% |

| 7 | 42% | 55% | 47% | 52% | 46% |

| 10 | 32% | 44% | 37% | 42% | 36% |

| 15 | 22% | 34% | 26% | 30% | 25% |

| 20 | 15% | 26% | 18% | 22% | 18% |

| Condition | Adjustment | Description | Mileage Factor |

|---|---|---|---|

| Excellent | +10% | Like new, minimal wear, low miles | Under 5k/yr |

| Good | 0% (Baseline) | Normal wear, well maintained | 5k–10k/yr |

| Fair | -10% | Visible wear, minor repairs needed | 10k–15k/yr |

| Poor | -20% | Major wear, significant repairs needed | Over 15k/yr |

| Mileage Range (mi) | Mileage Range (km) | Additional Depreciation | Typical Age |

|---|---|---|---|

| 0 – 10,000 | 0 – 16,093 | 0% | 0–2 years |

| 10,001 – 30,000 | 16,094 – 48,280 | 2–4% | 2–4 years |

| 30,001 – 60,000 | 48,281 – 96,561 | 5–8% | 4–7 years |

| 60,001 – 100,000 | 96,562 – 160,934 | 8–12% | 7–12 years |

| 100,001+ | 160,935+ | 12–18% | 12+ years |

| Scenario | Type | 5-Yr Value Retained | 10-Yr Value Retained |

|---|---|---|---|

| New Class A Diesel | Class A | 50–55% | 30–35% |

| New Sprinter Van Build | Class B | 60–65% | 42–48% |

| Mid-Range Class C | Class C | 55–60% | 35–40% |

| Entry-Level Travel Trailer | Travel Trailer | 55–62% | 38–45% |

| Premium Fifth Wheel | Fifth Wheel | 52–58% | 33–38% |

| Airstream Bambi / Caravel | Airstream | 70–78% | 55–62% |

For motorhomes (Class A, B, C), mileage plays a bigger role in depreciation than for towable RVs. A Class A with 80,000 miles will lose 8–12% more value than the same model with 30,000 miles. For travel trailers and fifth wheels, age and condition matter more since they dont accumulate road miles the same way.

RVs stored under cover (garage or carport) retain roughly 5–8% more value over 10 years compared to those stored outdoors. UV exposure, rain, and temperature swings accelerate exterior fading, seal deterioration, and roof damage. Covered storage can effectively slow depreciation by 1–2 percentage points per year.

Class A motorhomes shed roughly 20 to 25% in the first year alone, and Ive watched them settle to about 50% of their original value by year 5. Class B vans hold up better at around 14% first year loss. That gap is honestly wild.

Airstreams only drop 10% year one which is barely anything compared to a pop-up losing 22%. Mileage over 100,000 tacks on another 12 to 15% loss, and covered storage saves you about 5 to 8% over a decade.

How RVs Lose Value Over Time

The info below does not come from some computer program or automatic translator. It is based on actual user experiences, discussions in forums and experiences from the rv community, that one finds everywhere on the net.

An rv is like a car. Right after leaving the store, its price starts to quickly drop. New vehicles usually have higher resale value than used and rv units follow this same rule.

When one buys a fresh rv, it gives the feeling that one acts on a long-term dream, with promise of freedom and traces of adventures on the broad way. Even so, that purchase brings a downside that shows when comes the moment to sell: the depreciation.

depreciation of an rv estimates the percent decline of the value over time. It contrasts with the usual behavior of real estate, that most commonly gains value over the years. Various things affect how quickly an rv loses its value.

The hardest to control is simply the time. Travel mileage does not matter as much for the price of an rv as the time itself. During purchase of a new rv, one estimates that around 20% of its value disappears only because of the first trip form the store.

New rv units lose a big part of their value during the first year of ownership. The speed ranges by the model, but widely, when they leave the dealer for the second time, they already become much less precious. Depreciation happens, whether one uses the rv or leaves it standing.

According to most ratings, rv units lose 20% of there value during only one year after the purchase.

The yearly percentages paint a clear picture. During the first year, the depreciation stays around 20.50%. In the second year, it arrives at about 23.25%.

The third year marks 28.33%, the fourth around 32.17%, and in the fifth it climbs to 39.37%. The sixth year brings almost 42.27%, during the seventh close to 44.08%. Those values add up very quickly.

The speed of depreciation for an rv depends strongly on the quality of build, the care, the traveled mileage, the storage conditions and the kind of vehicle. Class A and Class B motor homes lose value similarly, while Class C rv units do that a bit more slowly and keep value slightly better. Class A motor homes are the biggest, with length between 30 and 45 or more feet.

They rank among the most expensive rv units, with new prices usually from 100 000 until 1 000 000 dollars. A rig that costs 1 000 000 dollars can lose even 200 000 dollars during the first year. Most travel trailers also lose value quite quickly.

Some lose 50% in three years, while others show almost no decline after that period. The brand has big presence.

In the used market, the best deal commonly finds itself in the range of three until seven years old. After seven years, if the owner did not care about regular repair and upkeep of seals and slide gaskets, the rv commonly drops in real money value, even without clear signs of water damage. Keeping an rv in good state can help steady the price after the early strong depreciation already ended.

rv units do not lose value on a fixed time plan. The best way to fairly estimate one of them is research past sales and price guides. Prices dropped a lot from the spike in 2022.

For instance, a trailer bought new for 23 600 dollars at the start of 2021 sold for up to 45 000 dollars during the spike in some areas.

If one leases an rv through the right program, that decline of value can indeed serve as a useful financial tool. Tax breaks, commercial write-offs and smarter ways of ownership can turn the depreciation into an advantage for the owner, instead of a downside. Rv units used for commercial goals, bought between September 27th 2017 and January 1st 2023, qualify for 100-percent bonus depreciation.

Past sales data from trusted websites can help follow trends of depreciation for different kinds of rv units. Cars, trucks, bikes, boats and rv units all lose value much morequickly than stuff like furniture and devices. That simply belongs to the nature of such things.